Bitcoin “Newbie Whales” Now Hold Unprecedented $7.3B Profit

[ad_1]

On-chain data shows the newbie Bitcoin whales hold an all-time high amount of unrealized profit following the latest rally in the asset to $60,000.

Bitcoin Short-Term Holder Whales Currently Carry All-Time High Profit

As explained by CryptoQuant founder and CEO Ki Young Ju in a new post on X, the profits of the newbie whales have hit unprecedented levels. The “newbie whales” here refer to the Bitcoin whales belonging to the “short-term holder” (STH) cohort.

The STHs include all the BTC investors who bought their coins within the past 155 days. Given this relatively small timeframe, the STHs are considered the newbie hands of the market.

The whales are defined as entities that are currently carrying at least 1,000 BTC in their wallets. Naturally, wallets associated with miners and centralized exchanges are excluded from this group as they don’t correspond to “normal” investors.

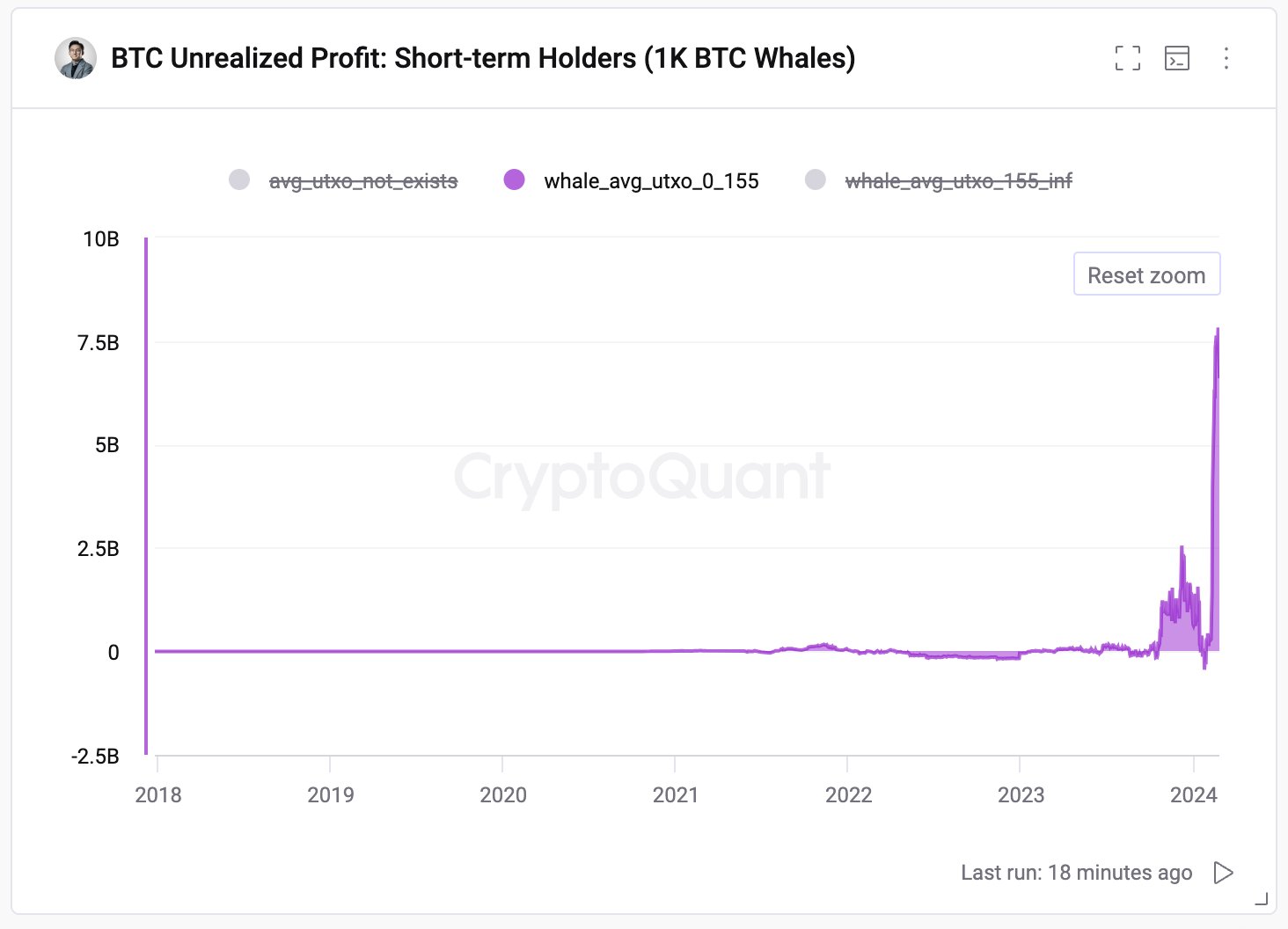

The STH whales, thus, would be holders who have been holding 1,000 BTC or more since less than 155 days ago. Here is a chart that shows the amount of unrealized profit that this segment of Bitcoin investors had been holding at the time Ju made the post:

The value of the metric seems to have shot up recently | Source: @ki_young_ju on X

As is visible in the chart, the unrealized profit held by the newbie Bitcoin whales has spiked alongside the latest rally in the cryptocurrency. The metric has been setting new all-time highs (ATHs) in this rally, meaning that the STH whales have never held this much profit.

When the CryptoQuant founder made the post, the unrealized profit held by this cohort totaled up to about $7.3 billion. Since then, BTC has only headed up, as it has now broken beyond the $61,000 level. As such, this amount would have risen even higher by now.

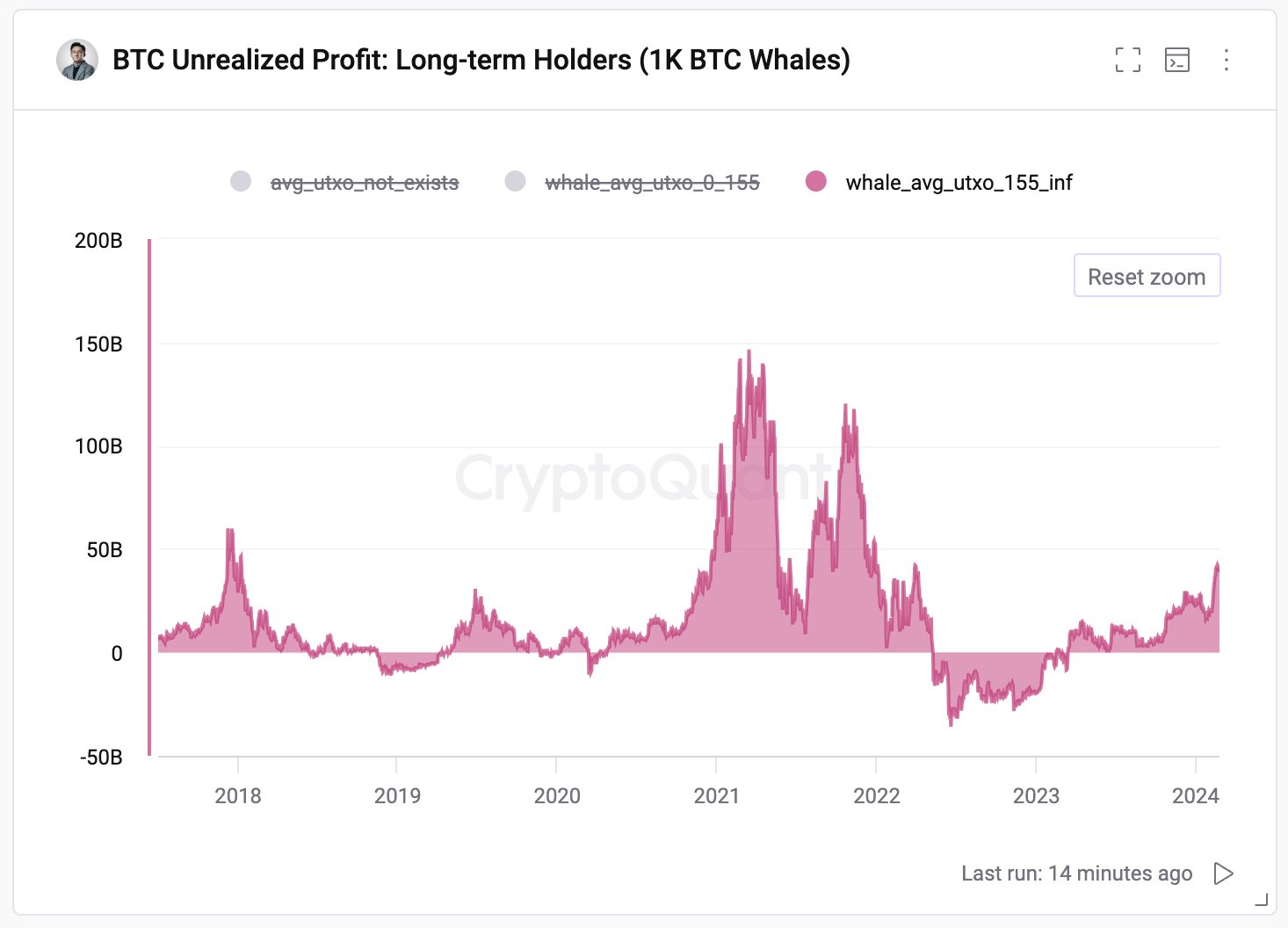

While the STH whales have been setting new ATHs, the “long-term holder” (LTH) whales have been far from achieving the same feat.

Looks like the value of the metric has been at notable levels recently | Source: @ki_young_ju on X

Unlike the STHs, who are fickle-minded and tend to sell quickly at any sight of FUD or FOMO, the LTHs are veterans who carry a strong resolve, not selling much at all, regardless of whatever is happening on the broader market.

In 2021, the LTH whales held peak profits of $145 billion, while their recent profit level was around $40 billion. Like always, though, as the cycle goes on and the bull rally takes place, these HODLers’ patience would pay off, with their profits again ballooning up.

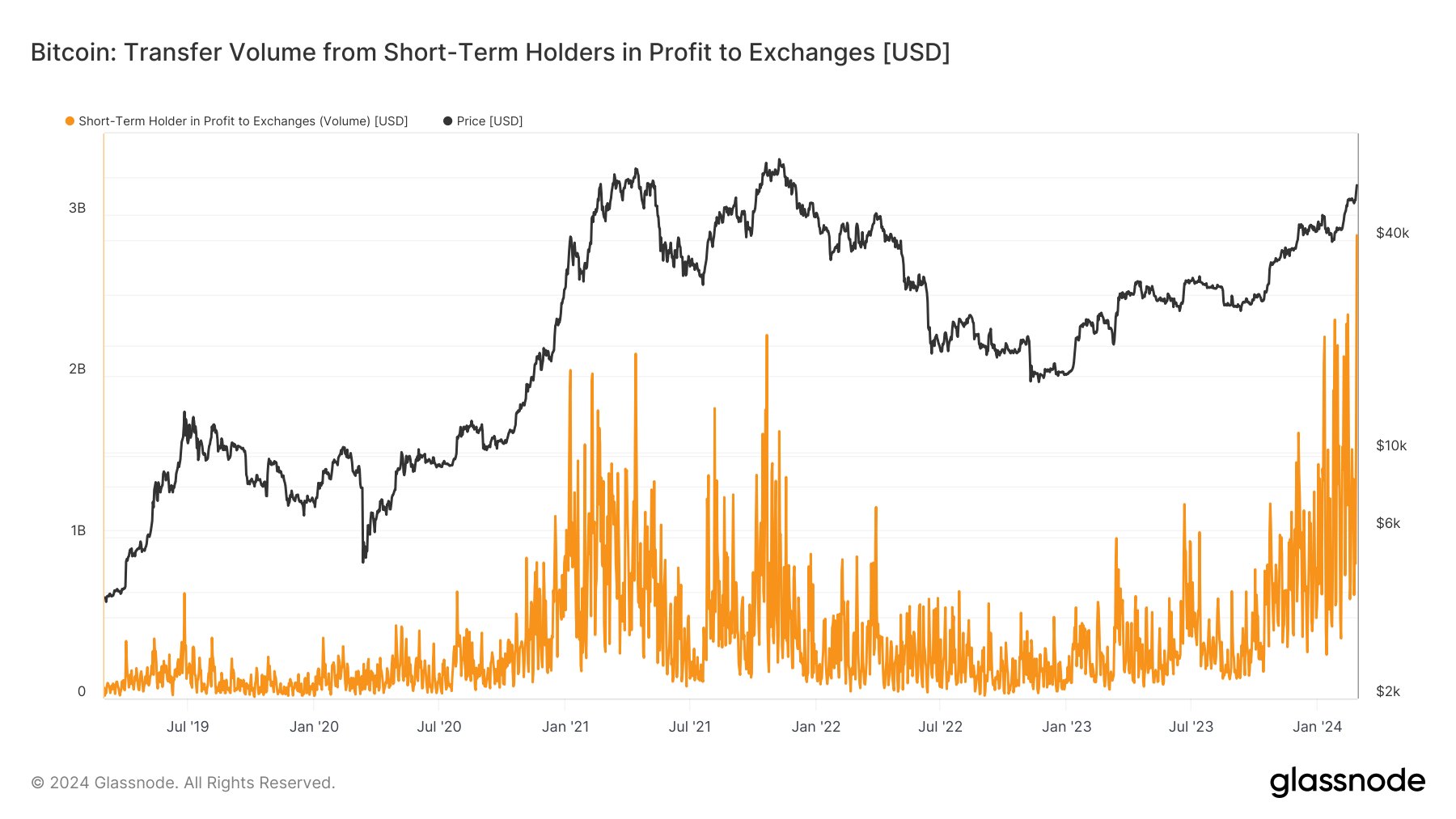

Given the high profits the STHs have held recently and their weak resolve, it wouldn’t be surprising if they were selling in this rally. Indeed, as analyst James Van Straten has shared in an X post, the STHs sent $3 billion in profits to exchanges when Bitcoin broke above $57,000.

The data for the transfer volume in profit from the STHs to exchanges | Source: @jvs_btc on X

Despite this high profit-taking, Bitcoin hasn’t been impeded so far, as the cryptocurrency’s price has only continued to march up.

BTC Price

At the time of writing, Bitcoin is trading around the $61,100 level, up 20% in the past week.

The price of the coin appears to have been sharply going up in the last couple of days | Source: BTCUSD on TradingView

Featured image from Mark Vihtelic on Unsplash.com, Glassnode.com, CryptoQuant.com, chart from TradingView.com

[ad_2]

Source link